What is decentralized finance (DeFi) ?

Unlike traditional financial systems, DeFi offers open and universal access to various services such as lending, borrowing, trading, insurance, and asset management.

Reading time: 7min

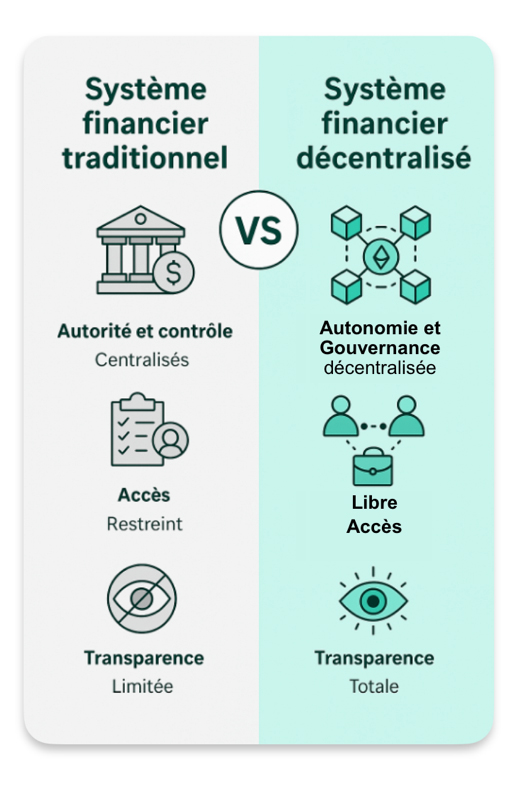

The financial landscape is evolving rapidly, driven by technological innovation and new investment approaches. Among them, decentralized finance (DeFi) is attracting growing interest, offering a more accessible, transparent, and independent system from traditional institutions. Based on blockchain and smart contracts, it provides alternative financial solutions that appeal to both institutional investors and individuals looking to diversify their holdings.

Definition of decentralized finance

Decentralized finance, or DeFi, includes a range of financial services accessible via blockchain, without traditional intermediaries such as banks or brokers. Relying on smart contracts deployed on public blockchains like Ethereum, DeFi enables secure, transparent, and automated transactions.

Unlike traditional financial systems, DeFi offers open and universal access to various services such as lending, borrowing, trading, insurance, and asset management. By removing intermediaries, it aims to make financial services more accessible and efficient.

How does DeFi work?

The main appeal of DeFi lies in its architecture, which is fundamentally different from traditional financial systems. Instead of relying on centralized institutions to control transactions and fund management, DeFi relies on innovative technologies that automate and secure financial interactions.

Three core pillars ensure its proper functioning:

1. Smart contracts: automated and transparent finance

At the heart of DeFi are smart contracts, autonomous computer programs that execute transactions as soon as a predefined condition is met. For example, when a user deposits cryptocurrencies as collateral to borrow a stablecoin like USDC, the smart contract locks the funds and instantly releases the loan, with no human intervention. These smart contracts ensure full transparency, as their code is publicly viewable on the blockchain.

2. Decentralized protocols: services accessible to all

DeFi is based on autonomous platforms that replace traditional banks and intermediaries. These protocols run continuously without human involvement and are accessible to anyone with an internet connection and a crypto wallet.

some of the best known:

- Uniswap: allows users to swap cryptos instantly without using a centralized platform. instead of a traditional order book, it uses liquidity pools provided by users.

- Aave: enables borrowing and lending of cryptocurrencies. loans are backed by collateral, and rates vary depending on supply and demand.

- Curve: specializes in stablecoin trading with reduced fees and optimized yields.

DeFi protocols require neither bank accounts nor identity verification (KYC), making these services accessible to everyone.

3. Tokens and stablecoins: the currency of DeFi

In decentralized finance, transactions are carried out using specific digital assets:

- Stablecoins (USDC, DAi, USDT): backed by traditional currencies or real assets to maintain a stable value. these are the “digital dollars” of DeFi, widely used for payments and loans.

- Governance tokens (Aave, Uni, Comp): allow holders to vote on protocol updates, much like shareholders in a company.

- Yield tokens: earned by participating in investment strategies like staking (locking crypto to secure a network and earn rewards) or yield farming (providing liquidity in exchange for interest).

With this automated and accessible infrastructure, DeFi redefines financial services by removing entry barriers and offering an alternative to traditional systems.

The advantages of DeFi

Beyond its technological innovation, DeFi stands out for its concrete benefits compared to traditional financial systems. transparency, accessibility, and returns are at the heart of this new approach.

1. Finance without intermediaries, more transparent and automated

In traditional finance, each transaction goes through a bank or broker, adding fees and delays. DeFi removes these intermediaries through smart contracts that automatically execute transactions based on preprogrammed rules.

Additionally, all operations are recorded on the blockchain, a public and immutable ledger. this ensures complete transparency: anyone can verify financial flows, reducing the risk of fraud or manipulation.

2. Global access, 24/7 and without restriction

DeFi is open to everyone, worldwide, with no geographic limitations or financial status requirements. all you need is an internet connection and a crypto wallet to access advanced financial services.

3. More attractive returns than traditional finance

DeFi offers several ways to generate income, often with higher returns than traditional investments:

- Staking

- Yield farming

- Lending and borrowing on platforms like aave

Screenshot of the aave platform on the ethereum network.

*APY(annual percentage yield) represents the annual yield percentage, accounting for compound interest. in other words, it’s the total gain over one year, including interest on the interest.

The limitations and challenges of DeFi

Some challenges need to be addressed for DeFi to scale and gain broader public trust.

1. Security and regulation: a dual challenge

DeFi protocols can be vulnerable to hacks exploiting weaknesses in their smart contracts. in 2024, over $2 billion was stolen across various DeFi platforms. unlike traditional banks with guarantees and insurance, users without secure key management or those investing in risky protocols can lose their funds with no recovery.

The lack of clear regulation increases this vulnerability.

2. Technical complexity and mass adoption

DeFi is built on advanced technologies, which can be difficult to use for non-technical users. this complexity slows mass adoption, especially among those unfamiliar with digital tools.

despite increasingly user-friendly interfaces, the learning curve remains steep, and the absence of customer support in decentralized systems creates friction for beginners.

3. Underestimated systemic risk

The interdependence of DeFi protocols creates a strong network effect. the collapse of the ust stablecoin in 2022 is a striking example: a single actor’s failure can trigger a domino effect, causing cascading liquidations and major market crashes.

Regtech and DeFi: compliance and security challenges

RegTech solutions play a key role in ensuring compliance and securing transactions in the DeFi ecosystem through automated auditing and transaction monitoring on the blockchain.

But what is RegTech?

RegTechs are regulatory technology companies that create tools to simplify the application of legal standards. their goal is to reduce costs and the risk of error while improving compliance. they offer flexible, configurable, easily integrated, reliable, secure, and cost-effective tools.

Conclusion

DeFi is disrupting the financial sector by offering a more accessible, transparent, and efficient alternative to traditional services. rather than opposing traditional finance, a hybrid model seems to be emerging—combining autonomy and security.

Sources :

💬 Subscribe now to stay informed about the latest cryptocurrency regulations and Web3 trends!