DCA vs Market Timing: Which strategy?

In short, DCA is designed for investors, whereas Market Timing aligns more closely with the mindset of a trader — although some investors do attempt to “time” their entries and exits.

Reading time: 7 minutes

When it comes to investing in cryptocurrencies or the stock market, two main strategies emerge:

- Dollar Cost Averaging (DCA): a gradual investment method where you invest the same amount at regular intervals.

- Market Timing (or Stock/Crypto Picking): aiming to buy or sell at the best possible moments, by capturing market highs and lows.

While many dream of predicting markets to maximize their returns, reality is far more complex. In this article, we take a deeper look at both strategies to help you understand which method fits your investor profile.s deux stratégies pour vous aider à comprendre la méthode adaptée à chaque profil.

Investing or trading: Who are we talking about?

Before diving deeper, it’s important to clear up a common misconception.

Investing typically involves a medium to long-term approach, characterized by:

- A horizon of several years.

- A gradual construction of wealth.

- Acceptance of economic cycles and their fluctuations.

Trading, on the other hand, is based on:

- Short to medium-term movements.

- Aiming for faster profits.

- Frequent executions with a clearly defined strategy.

In short, DCA is designed for investors, whereas Market Timing aligns more closely with the mindset of a trader — although some investors do attempt to “time” their entries and exits.

What exactly is Market Timing?

Market Timing relies on the idea of optimizing your buying and selling by anticipating the evolution of financial markets. In simple terms: buy low, sell high.

While appealing in theory, it’s extremely difficult to execute in practice because it requires correctly predicting two critical events:

- Knowing when to sell (before a downturn).

- Knowing when to buy (before an upswing).

A mistake on either side can completely eliminate the supposed advantage of timing.

Is Market Timing a good idea?

In 2024, the S&P 500 recorded a +23.3% performance, illustrating the resilience of risk assets despite periods of volatility. However, attempting to predict major corrections to optimize investments remains a risky strategy.

Markets do fluctuate, but consistently waiting for a correction can cause you to miss out on some of the best performances, especially over the long term.

This is even more true in crypto: volatility is extreme, with 20–30% drops being frequent — as well as equally sharp rebounds. Attempting to time crypto markets can often feel like an impossible mission, which is why professional traders usually dominate this strategy.

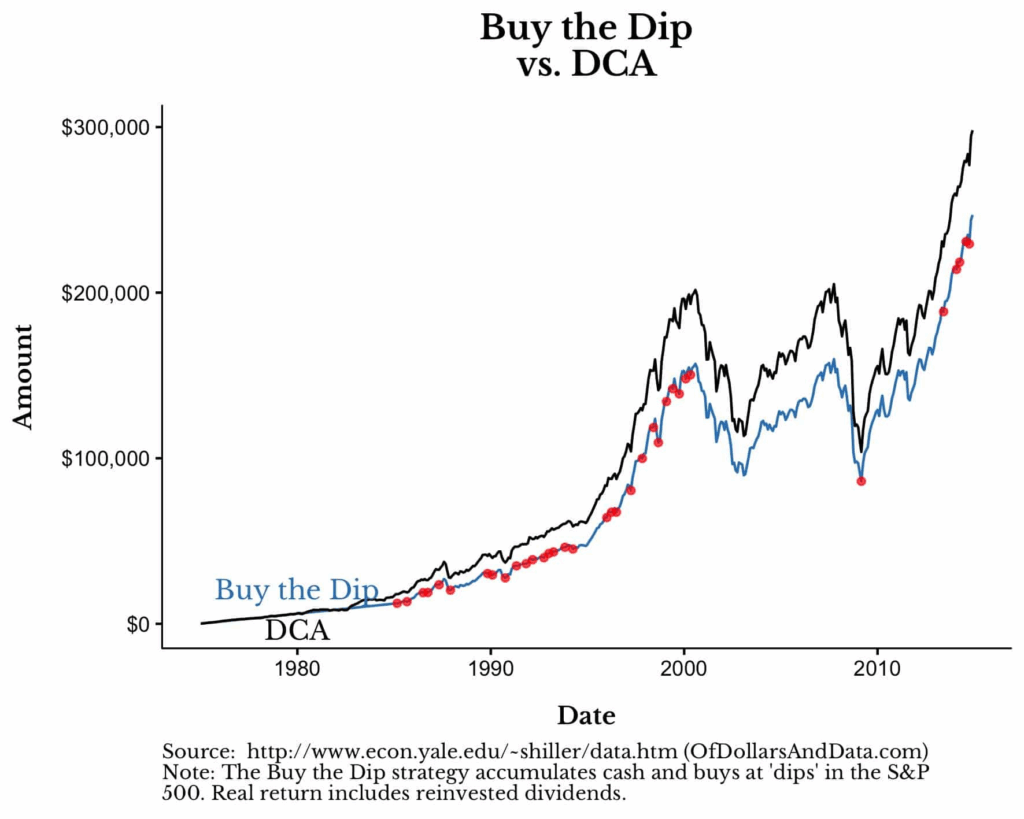

The potential gains of successful Market Timing

In theory, if you could perfectly time the market, the returns would be extraordinary.

For example, a Buy & Hold investment in the S&P 500 between 2002 and 2022 would have multiplied your capital by 6 (+9.5% per year), but perfect timing could have generated much higher returns.

In practice, it’s a different story:

According to Morningstar, investors who attempt market timing underperform by an average of 20% compared to the actual returns of the funds they choose.

Moreover, several studies show that over 90% of individual investors fail to outperform passive strategies over the long term.

The real risks and pitfalls of Market Timing

Successfully timing the market requires getting two critical decisions right — and that’s extremely rare due to several factors:

- Human psychology: It’s emotionally difficult to buy after missing a rally or to avoid the fear of “overpaying.”

- Fees and taxation: Market timing often leads to more trades (higher transaction costs) and potentially higher capital gains taxes.

- Opportunity cost: Missing just a few of the market’s best days can significantly reduce long-term returns.

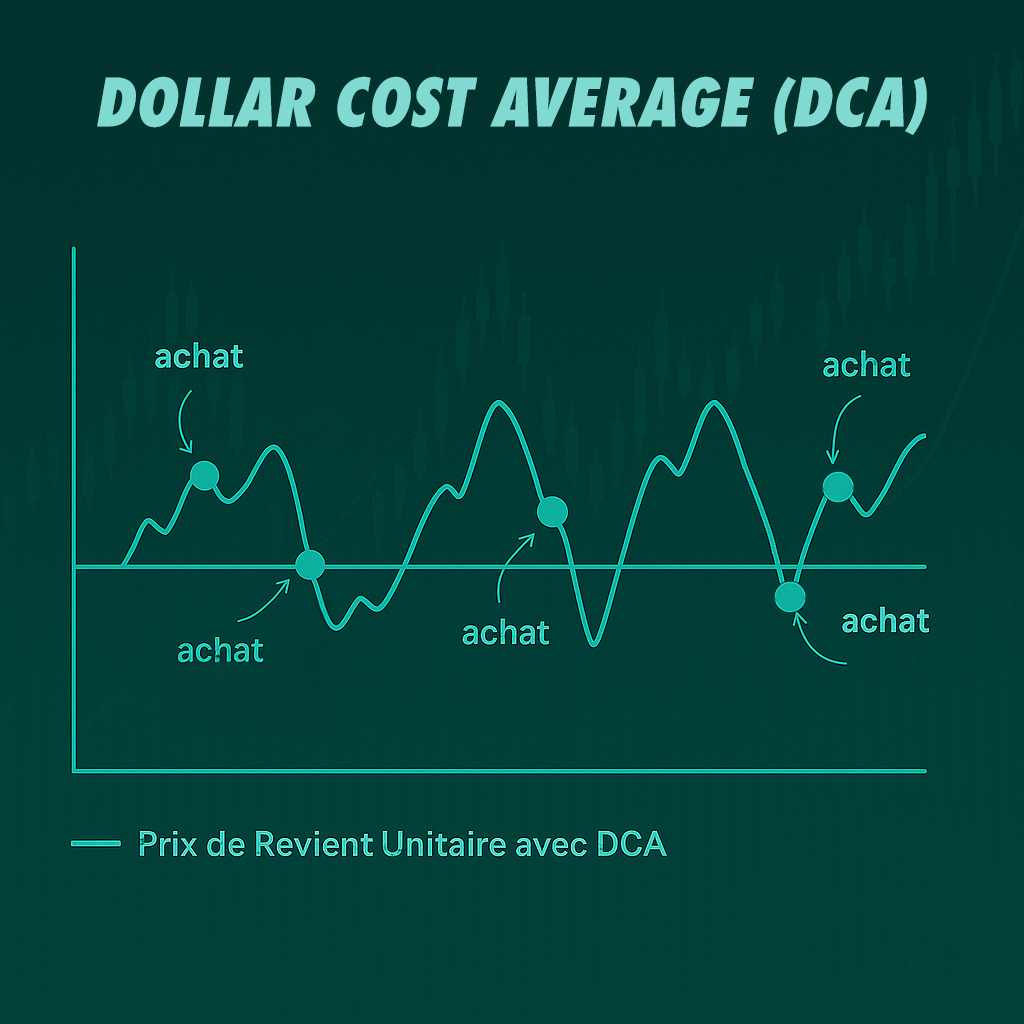

DCA: The stress-free path for long-term investors

DCA consists of investing a fixed amount at regular intervals, regardless of market conditions. This strategy allows investors to:

- Smooth out their purchase prices over time.

- Eliminate the need for market timing.

- Reduce stress from market fluctuations.

- Stay disciplined over the long term.

Accessible investments through DCA: A practical approach

Dollar Cost Averaging is easily applicable across many asset classes accessible to retail investors.

On the stock market, Exchange Traded Funds (ETFs) are a preferred vehicle for DCA strategies.

By tracking large and diversified indices like the S&P 500 or MSCI World, ETFs allow investors to regularly invest small amounts and benefit from market movements while compounding returns over time.

For individual stocks, DCA works well when focused on large-cap, financially sound, and established companies.

Applying DCA to highly volatile or illiquid stocks, however, can increase risk, making diversified ETFs a better fit for non-specialist investors.

DCA also applies to corporate bonds, particularly for building a defensive portfolio gradually.

It can be easily implemented via automated contributions through vehicles like PEA (French stock savings plans) or standard brokerage accounts.

Finally, in the crypto space, DCA has become increasingly popular.

Given the high volatility, investing gradually in major assets like Bitcoin or Ethereum remains a prudent way to gain exposure without attempting to time the market.

At ChainEcos, we emphasize the importance of focusing on solid, established assets over speculative altcoins.

DCA vs Market Timing: Comparative table

| Criteria | Market Timing | DCA |

| Execution difficulty | High | Very easy |

| Emotional stress | High | Low |

| Accessibility | Experienced traders | Beginners & investors |

| Potential returns | Very high (but rare) | Moderate but consistent |

| Skills required? | Yes (analysis, psychology) | Minimal |

| Risk of underperformance | High if repeated mistakes | Low |

| Taxes and fees | Higher | Lower |

A Possible Hybrid Approach?

Some investors take a pragmatic approach:

- 90% of their portfolio invested via DCA in large-cap cryptos.

- 10% reserved for thoughtful market timing opportunities.

This allows them to combine the stability of DCA with the agility of selective timing.

Still, market timing demands exceptional competence.

For most individuals without deep expertise in fundamental or technical analysis, it’s usually wiser to focus on DCA or to delegate active trading to professionals.

In crypto, for instance, a novice would have historically had better success applying DCA on Bitcoin or Ethereum rather than trying to time low-cap speculative altcoins.

Conclusion : Simplicity or performance?

For anyone seeking steady growth, peace of mind, and discipline over the long term, DCA is the golden path.

For those willing to devote time, accept setbacks, and master emotional discipline, allocating a portion to market timing can make sense.

Beyond performance, trading or strategic market timing can also become a genuine path to financial freedom.

By building solid skills and a rigorous discipline, some turn active investing into a full-fledged career — offering the freedom to work remotely, manage their time, and escape traditional employment structures.

Of course, this requires resilience, education, and a professional mindset, but for many, it’s an opportunity to build a freer and more independent life.

Ultimately, discipline beats luck.

In investing, the best strategy is the one you can stick with over time.

And you — are you Team DCA or Team Market Timing?

Tell us in the comments!

Sources :

💬 Subscribe now to stay updated on the latest cryptocurrency regulations and Web3 trends!