Bitcoin: A strategic move for companies?

Integrating Bitcoin into a treasury management strategy is no longer a fringe idea. It is a serious, regulated, and modern option. Used wisely, it can bring diversification, flexibility, and long-term value potential.

Reading time : 7 minutes

In an economic environment where uncertainty has become the norm, companies are rethinking how they manage their treasury. Beyond traditional approaches, one asset is gradually making its way into strategic financial discussions: Bitcoin.

Long considered a speculative asset reserved for individuals or alternative markets, Bitcoin is now being integrated into the financial management of institutional players and innovative companies. But why this choice? What are the advantages, the risks, and, most importantly, the framework for businesses?

An in-depth look at a trend that is no longer limited to the early adopters.

Why integrate BTC into your corporate treasury?

Securing part of your assets in a non-dilutable asset

Bitcoin is based on a simple but powerful principle: limited, transparent, and predictable issuance. Unlike fiat currencies, whose monetary policies can change, Bitcoin is controlled by no government or central bank. This algorithmic feature attracts companies looking for assets that are insensitive to political decisions or rate manipulation.

Intelligently diversifying exposure

Most companies concentrate their treasury in traditional bank products, which are often low-yielding and subject to the same economic dynamics. Bitcoin, although influenced by global macroeconomic cycles, operates on its own decentralized mechanisms, with global liquidity and a fixed supply. This makes it a complementary diversification tool, capable of introducing a new form of resilience into the company’s financial structure.

Mobilizing a liquid, accessible, and international store of value

Bitcoin operates continuously, 24/7, with no borders or intermediaries. For a company, this means instant access to a reserve that can be mobilized at any time, including outside banking hours or in case of temporary disruptions to the traditional system.

This global liquidity makes it a flexible operational tool, useful for anticipating international payments, securing an emergency fund, or responding to occasional cash flow needs without going through slow or restrictive banking circuits.

What risks and limitations should be anticipated?

Volatility that requires caution

Bitcoin remains an asset subject to high volatility, both upward and downward. It is not a guaranteed yield product, and managing it requires a long-term horizon and a thoughtful level of exposure.

Accounting treatment remains restrictive

Since 2023, the MiCA regulation governs digital assets at the European level. In France, BOFiP and the General Accounting Plan specify that Bitcoin is recorded as a non-depreciable intangible asset. CFOs, auditors, and accounting firms now have a clear framework for its inclusion on the balance sheet, subject to compliance with custody, valuation, and reporting procedures.

Under this framework, only a permanent loss of value is recorded: capital gains are not recognized as long as the asset is not sold. This can create a gap between the real value of the asset and its accounting treatment, but it also offers a tactical advantage: there is no taxation or impact on earnings as long as the Bitcoin is held.

A simple and relatively protective framework, to be integrated into a rigorous management vision.

A technical and security management challenge

Holding Bitcoin directly requires handling critical issues: secure custody, multisignature procedures, key loss, fraud, wallet transfers, etc.

The company must select regulated service providers or implement strict internal processes.

Exposing your company to Bitcoin: ETF or direct purchase?

Companies wishing to invest in Bitcoin today have two main options: Bitcoin Spot ETFs or direct purchase (“spot”) via an exchange platform.

The Bitcoin Spot ETF, the simplest solution

Launched in 2024, these exchange-traded products allow exposure to Bitcoin without holding it directly. They are regulated, easy to integrate into accounting, and managed by institutional players like BlackRock or Fidelity.

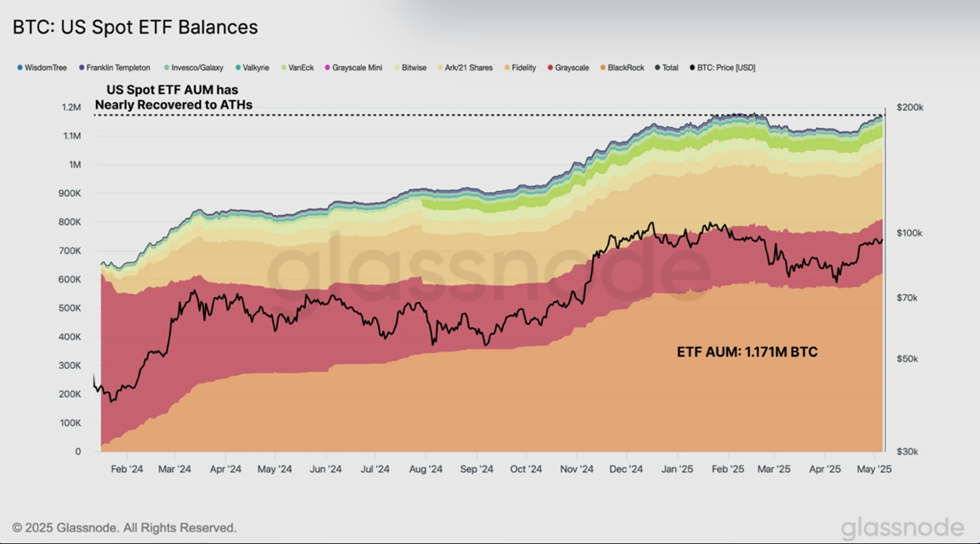

Since their launch, these ETFs have experienced massive success, attracting tens of billions of dollars in inflows within just a few months. This momentum has strengthened Bitcoin’s legitimacy as a financial asset and made it more accessible to companies and institutional investors alike.

Bitcoin Spot ETF Assets Under Management (AUM) Evolution (Glassnode).

This is an excellent option to benefit from BTC performance without worrying about technical aspects.

However, ETFs remain purely financial products: they do not allow operational use of Bitcoin (payments, transfers, autonomous custody).

Spot purchase, for more freedom (but more responsibility)

Buying Bitcoin directly via an exchange platform gives full control over the asset. The company can hold it, use it, or transfer it. However, this requires strict management of security, storage, and crypto accounting, or using a specialized provider.

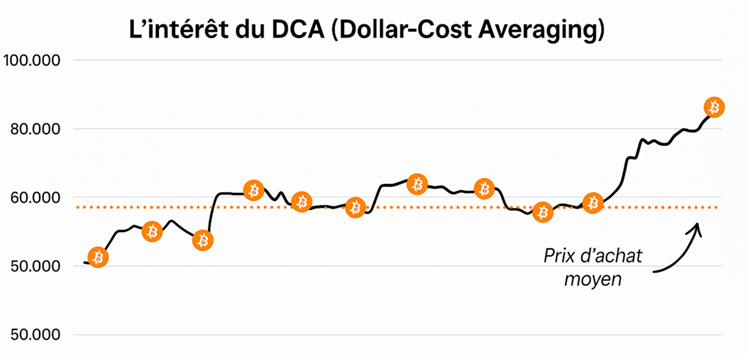

In this context, we recommend adopting a progressive purchasing strategy (DCA) to smooth exposure over time and reduce the impact of volatility on the entry price.

Delegated management: simplicity, security, support

For companies wishing to integrate Bitcoin without adding complexity to their organization, alternative investment funds specialized in digital assets are now available. These structures offer a secure, regulated, and controlled framework, allowing part of the treasury to be allocated to crypto markets while benefiting from professional support.

If you are considering this type of approach, we can help you explore available options and structure a strategy aligned with your objectives.

In our view, Bitcoin represents an interesting lever to energize part of the corporate treasury, provided it is approached with prudence and structure. It is not about converting everything, but rather making it a complementary allocation, considering accounting, tax, and operational implications. A progressive, rational, and controlled approach remains essential.

Conclusion

Integrating Bitcoin into a treasury management strategy is no longer a fringe idea. It is a serious, regulated, and modern option. Used wisely, it can bring diversification, flexibility, and long-term value potential.

Sources:

- MiCA Regulation – EUR-Lex

- Légifiscal – Investing Company Treasury in Cryptocurrency

- ETFDB – Bitcoin ETFs

💬 Subscribe now to stay updated on the latest cryptocurrency regulations and Web3 trends!